As an avid investor in the world of crypto assets, I'm always on the lookout for assets with strong potential. VARA, with its promising use cases and innovative technology, certainly caught my eye. I diligently accumulated a portion of my portfolio in VARA on Coinbase, eager to explore its potential within decentralized applications (dApps). However, my enthusiasm was abruptly shattered by an unexpected email: Coinbase announced the delisting of VARA.

For the past 2 months, crypto market has been plunging down. It's not easy to see your portfolio slain. VARA was not an expensive asset anyway, but certainly lost like 50% of it's value. Noticing this market changes, I did quite some significant buys lately.

Only to receive these surprising news that Coinbase will unlist VARA from 20th March. A quick search revealed a notable absence of information regarding Coinbase's reasoning behind this decision. The lack of transparency surrounding the delisting raised questions, but in the fast-paced and often unpredictable realm of cryptocurrency, unexpected turns are part of the deal.

The reality of the crypto market is that it's inherently high-risk. I've always maintained a prudent approach, employing dollar-cost averaging to mitigate potential losses. This strategy proved valuable as the recent market downturn significantly impacted my VARA holdings, along with a large portion of the broader crypto market. With the looming unlisting date, the prospect of further value erosion was a serious concern.

My portfolio strategy was two-fold: a portion of my VARA was actively staked, contributing to network security and earning rewards, while the remaining portion was held on Coinbase for trading and exploration. Coinbase's announcement that they would automatically convert remaining VARA to USD on the delisting date presented a critical decision point. Waiting for the automatic conversion meant accepting the current, significantly reduced value of my holdings. It's simply not realistic to think I can sell my VARA holdings on Coinbase for a profit until the official unlisting date.

To safeguard my investment, I opted for a proactive approach. I swiftly transferred all my VARA from Coinbase to my on-chain staking account. This move effectively bypassed the forced conversion and allowed me to retain control of my assets. By moving it to the staking account, I will be able to wait for the market to recover and for the staking rewards to accumulate.

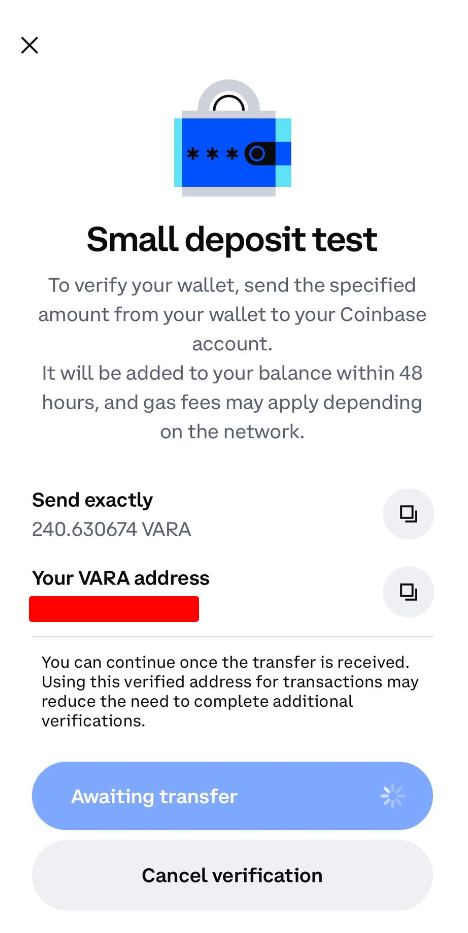

There was just a hiccup along the way, meaning that I had to prove the ownership of my wallet address (again). For some weird reason, this takes time to happen and I think it's because of some Coinbase internal issues. I managed to do that after a half an hour and I transferred the holdings to my wallet. I just staked them and hope the market situation will get better!

This experience underscores the importance of adaptability and resilience in the crypto space. While the unlisting of VARA on Coinbase was undoubtedly a setback, I remain focused on the long-term potential of my investments. I'm choosing to remain patient, allowing the market to stabilize and the staking rewards to accrue. In the volatile world of cryptocurrency, keeping your hopes up and adapting to the changing landscape is crucial.